- #Rbc employee login my information updater client how to

- #Rbc employee login my information updater client full

For more program details, please read the FAQ below. Eligible applicants can access funding up to $6.25 million CAD (maximum loan amounts dependent on business size) to cover operating expenses (such as rent, payroll and other operating expenses) and working capital needs. IMPORTANT: Please note that enrolling for CRA Direct Deposit through your RBC Online Banking for Business or RBC Express does not register you for the Government’s CEWS. The BDC Co-Lending program is designed to support Canadian businesses of all sizes that have been negatively impacted by COVID-19.

#Rbc employee login my information updater client how to

If you are eligible and expecting a CRA payment of more than $25 million, click here for details on how to receive your payment thought the Large Value Transfer System. CRA Direct Deposit is a quick, safe and secure way to receive eligible amounts to be paid to you by the Canada Revenue Agency (CRA) such as CEWS, should you be eligible for this program. You should also enroll for CRA Direct Deposit by logging into your RBC Online Banking for Business or RBC Express platform. For detailed information about the program, eligibility, and how to apply, refer to the Government of Canada’s site. provides eligible employers that have experienced an eligible reduction in revenue to receive a subsidy of 75% of employee wages for up to 12 weeks, retroactive from March 15, 2020, to June 6, 2020.

#Rbc employee login my information updater client full

Please see below for the full CEBA FAQ, including further details about the CEBA eligibility criteria in Q6. If your business was not previously eligible under the former payroll criteria ($50,000 to $1,000,000), please log into your RBC Online Banking for Business to re-submit your enrollment form.

The criteria for an organization’s total employment income paid in the 2019 calendar year is now between $20,000 and $1,500,000 CAD. *UPDATED* The Government of Canada has updated the eligibility criteria related to employer payroll requirements. As part of this, you if you have employees, and thus, the required payroll information to be eligible for the program. To be eligible for CEBA, you must meet the Government of Canada’s requirements outlined in Q6 of the FAQ below. If you are an RBC Express client, please contact your RBC Account Manager for separate instructions to enroll for CEBA. If you are not registered for online banking, click here to enroll in RBC Online Banking for Business. If you believe you are eligible but have not received a link, please call our dedicated CEBA support line at To enroll for CEBA, log into your RBC Online Banking for Business.

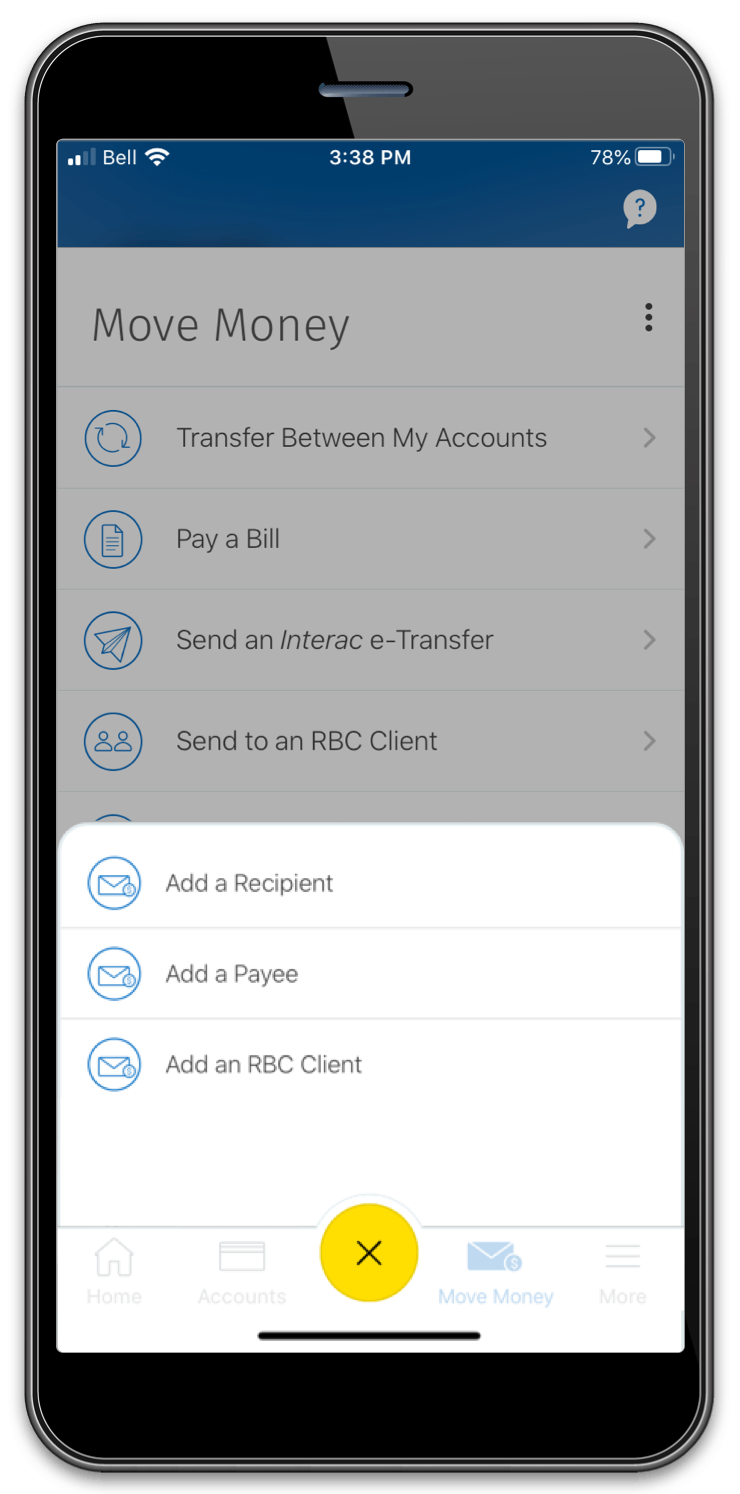

Please log into RBC Online Banking for Business to enroll. Eligibility is based on criteria established by the Government of Canada and this has recently been updated. RBC is committed to helping business clients access the government’s Canada Emergency Business Account (CEBA). If you collect RBC Rewards points, you can easily redeem them for travel, merchandise, gift cards and more at If you earn West Jet dollars, Avios or Asia Miles, you can redeem directly with the airline loyalty program connected to your card. Browse our no annual fee cards or use our card selector to help narrow down the benefits that are most important to you. Some of our cards offer more benefits with an annual fee, while others have no annual fee at all. They’re also an easy way to establish a credit history! Use our credit card selector to find a card that's right for you and apply online in just a few easy steps.

They’re convenient and secure, and help give you the freedom to manage your finances, cover unexpected emergencies and also take advantage of rewards and special insurances. Credit cards are important for things like making hotel reservations, car rentals, or online purchases. For more information, view the Zero Liability policies by Visa and Mastercard. Provided you’ve take reasonable precautions to protect your PIN and your card, you’re covered for any fraudulent charges both online and in-store. Learn more about credit card lock and we’ll be happy to help you. You can easily lock and unlock your card through RBC Online Banking or the RBC Mobile app by selecting the card you want to lock and switching the toggle for Lock Card.

0 kommentar(er)

0 kommentar(er)